Delaware Income Tax Brackets 2025. This tool is designed for simplicity and ease of use, focusing solely on income. A quick and efficient way to compare annual.

2025 Bracket Matrix Calculator Helge Brigida, If you make $70,000 a year living in wisconsin you will be taxed $10,401. A top bracket of 7.25% is imposed on income over $5 million for 2025 & 2025.

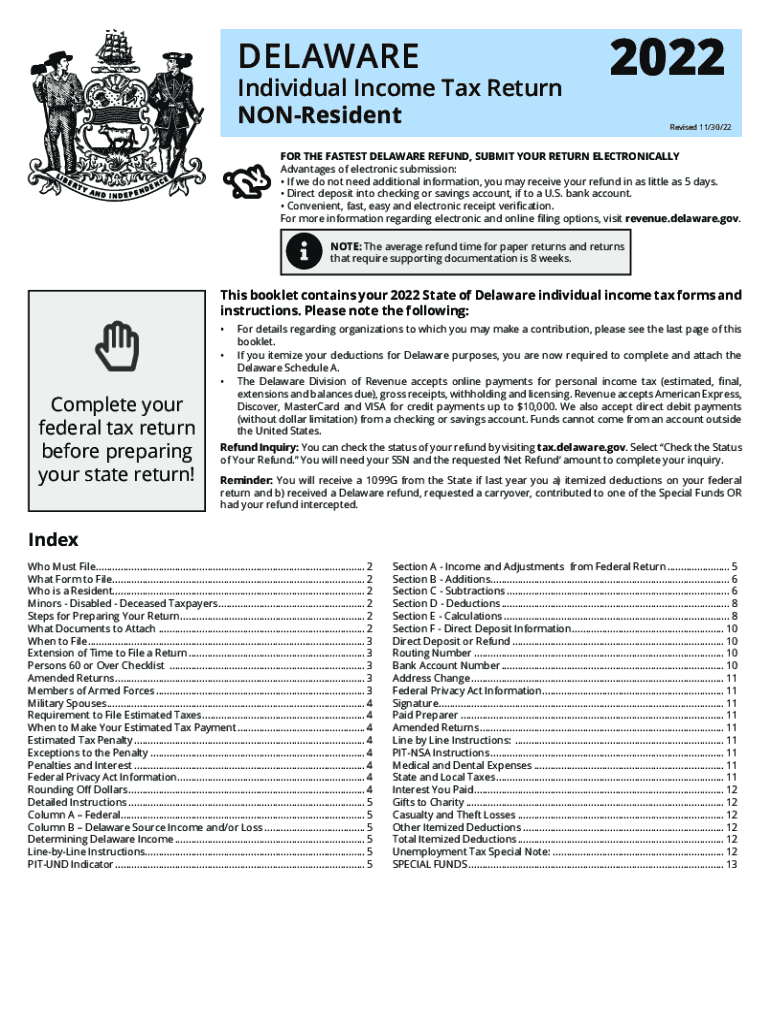

Delaware Taxes 20222024 Form Fill Out and Sign Printable PDF, There are seven (7) tax rates in 2025. The current tax brackets range from 2.2% for taxable income of $5,000 or less to 6.6% for taxable income of $60,000 or more.

When Are Taxes Due For California Residents 2025 Devin Feodora, Calculate your total tax due using the de tax calculator (update to include the 2025/25 tax brackets). In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Federal Tax Earnings Brackets For 2025 And 2025 Investor Insights 360, Your location will determine whether you owe local and / or. Updated on apr 24 2025.

What Are Tax Brackets, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in delaware. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2025 Irs Tax Brackets Chart Printable Forms Free Online, A top bracket of 7.25% is imposed on income over $5 million for 2025 & 2025. Income tax brackets, rates, income ranges, and estimated taxes due.

2025 State Tax Rates and Brackets Tax Foundation, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Delaware has a 8.70 percent corporate income tax rate and also levies a gross receipts tax.

Idaho Tax Calculator 2025 Nevsa Adrianne, The state income tax in delaware is progressive, which means that the more you earn, the higher your tax rate will be. Delaware does not have any state or local sales taxes.

10+ Calculate Tax Return 2025 For You 2025 VJK, Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual delaware salary calculator. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in delaware.

Tax brackets over the past century FlowingData, State income tax brackets range from 2.2% (taxable income from $2,001 to $5,000) to 6.6% (taxable income above $60,000). The salary tax calculator for delaware income tax calculations.