Florida Mileage Rate 2025. The medical mileage rate may also increase slightly, from current 21 cents to 22 cents. The irs mileage rate for 2025 is 67 cents per mile driven for business use.

The irs mileage reimbursement rate is a deduction you can take for using a vehicle for qualifying. If your annual business mileage for 2025 is 15,000 miles, then your 2025.

Irs Mileage Reimbursement 2025 Rate Chart Bunni Coralyn, To determine the county a destination is located in, visit the census geocoder.

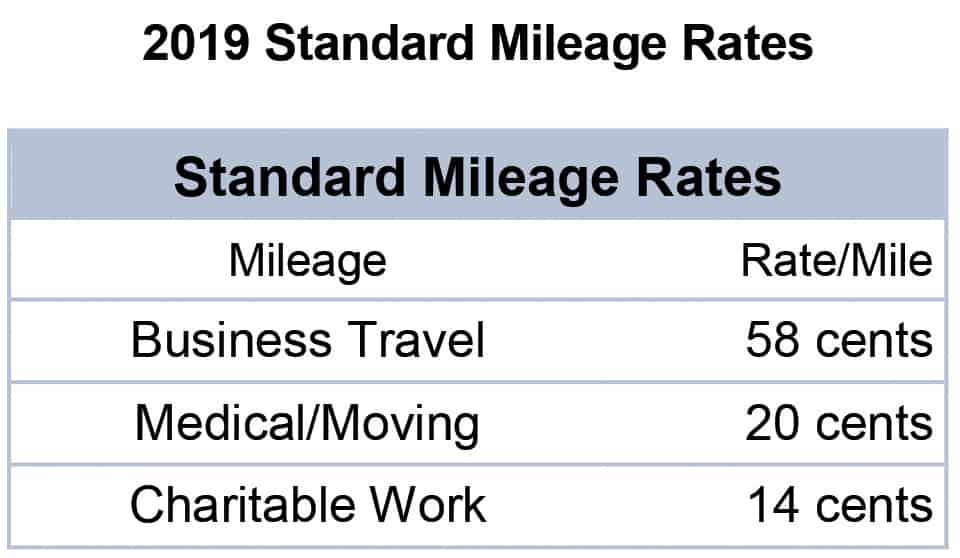

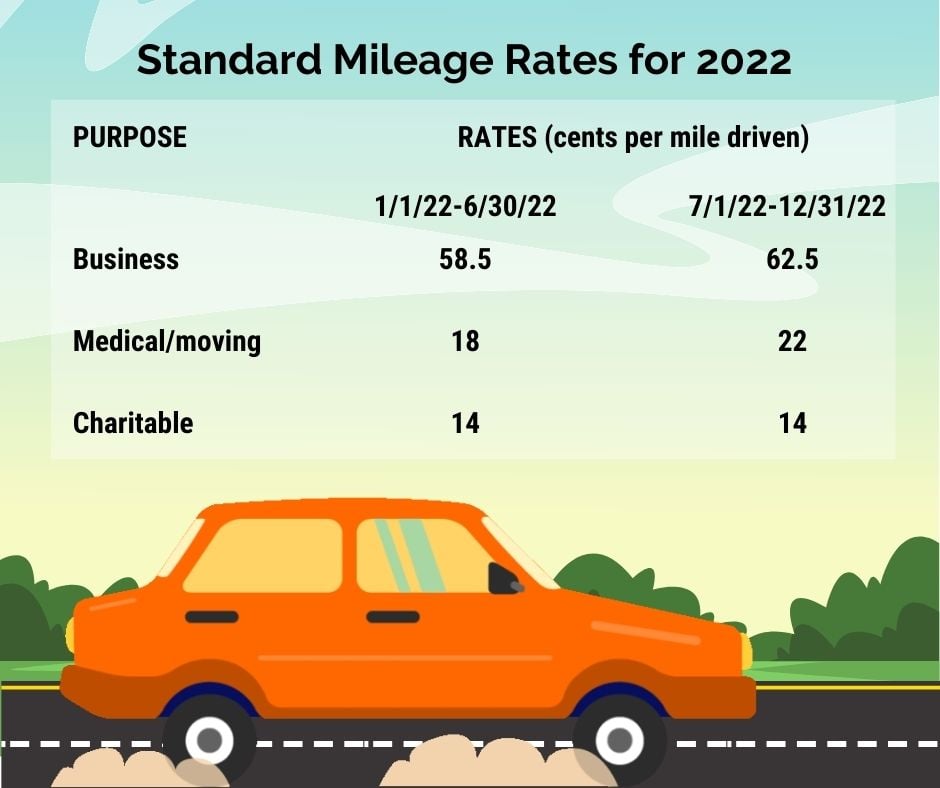

Florida Mileage Reimbursement Rate 2025 Janot Loralee, 17 rows find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

State Of Florida Mileage Reimbursement Rate 2025 Tova Melania, Irs mileage rates for 2025 and 2025.

Florida Mileage Rate for 2025 and What It Means for You, Get a sneak peek at the anticipated irs mileage rate for 2025, including predictions for business, medical, and charity rates.

Revenue Canada Mileage Rate 2025 Samantha Marshall, The simple way to calculate a mileage reimbursement is to multiply business mileage by the irs mileage rate.

Revenue Canada Mileage Rate 2025 Samantha Marshall, Since 2011, the irs mileage rate changes have fluctuated, going up for a few years, going down for a few years after that, then going back up for a bit, and so on.

Business Mileage Rate 2025 Florida Evita Atalanta, The medical mileage rate may also increase slightly, from current 21 cents to 22 cents.

Business Mileage Rate 2025 Florida Evita Atalanta, As we approach 2025, small business owners need to prepare for changes in tax laws that could impact their mileage deductions.

Kilometer Rate 2025 Nz Austin Carr, Broader economic trends also impact the standard mileage rate.

Revenue Canada Mileage Rate 2025 Samantha Marshall, 17 rows find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.